Other key reports include the January ISM manufacturing index on Monday, January vehicle sales on Tuesday, the ISM non-manufacturing index on Wednesday, and the December Trade Deficit on Thursday.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% decrease in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December at 55.5%. The employment index was at 56.8%, and the new orders index was at 57.3%

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.0 decrease in December orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 265 thousand.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $38.0 billion in December from $39.0 billion in November.

8:30 AM: Employment Report for January. The consensus is for an increase of 230,000 non-farm payroll jobs added in January, down from the 252,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 5.6% in January from 5.6% the previous month.

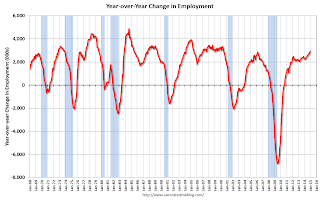

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.95 million jobs, and that should increase further in January.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

Notes: The annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014.

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. It is important to note that "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods". Someone better alert Rick Santelli at CNBC!

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $15.0 billion.