Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 225,000 payroll jobs added in March, up from 212,000 in February.

• At 10:00 AM, the ISM Manufacturing Index for March. The consensus is for a decrease to 52.5 from 52.9 in February. The ISM manufacturing index indicated expansion in February at 52.9%. The employment index was at 51.4%, and the new orders index was at 52.5%.

• At 10:00 AM, Construction Spending for February. The consensus is for a 0.2% increase in construction spending.

• Early: Reis Q1 2015 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 16.8 million SAAR in March from 16.2 million in February (Seasonally Adjusted Annual Rate).

Tuesday, 31 March 2015

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since September 2008

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined slightly in February to 1.83% from 1.86% in January. The serious delinquency rate is down from 2.27% in February 2014, and this is the lowest level since September 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate was declined in February to 1.81%. Freddie's rate is down from 2.29% in February 2014, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.44 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will be close to 1% in late 2016.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal at the end of 2016. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog, especially in judicial foreclosure states like Florida.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate was declined in February to 1.81%. Freddie's rate is down from 2.29% in February 2014, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger imageThe Fannie Mae serious delinquency rate has fallen 0.44 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will be close to 1% in late 2016.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal at the end of 2016. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog, especially in judicial foreclosure states like Florida.

Restaurant Performance Index shows Expansion in February

Here is a minor indicator I follow from the National Restaurant Association: Softer sales offset by stronger optimism in February's RPI

Click on graph for larger image.

Click on graph for larger image.

The index decreased to 102.6 in February, down from 102.7 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading - and it is likely restaurants are benefiting from lower gasoline prices and are having to raise wages - a little - to attract and retain workers.

Despite dampened sales and customer traffic levels as a result of extreme weather in parts of the country, the National Restaurant Association’s Restaurant Performance Index (RPI) held relatively steady in February. The RPI stood at 102.6 in February, down slightly from a level of 102.7 in January.

In addition, February marked the 24th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“With same-store sales and customer traffic levels being impacted by challenging weather conditions in parts of the country, the Current Situation component of the RPI declined in February,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, this was offset by a solid improvement in the Expectations component of the index, as restaurant operators are increasingly optimistic about business conditions in the months ahead. As a result, the overall RPI held relatively steady in February.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 102.6 in February, down from 102.7 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading - and it is likely restaurants are benefiting from lower gasoline prices and are having to raise wages - a little - to attract and retain workers.

A Comment on House Prices: Real Prices and Price-to-Rent Ratio in January

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In January 2015, the index was up 4.5% YoY. However the YoY change has only declined slightly over the last five months.

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect (as some) for the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.9% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

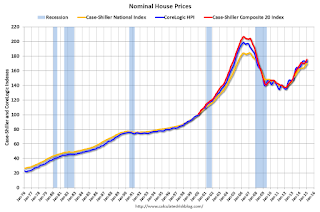

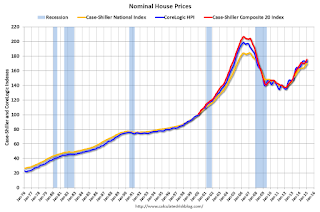

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to May 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to December 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to March 2003, and the CoreLogic index back to April 2003.

In real terms, house prices are back to 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to March 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and maybe moving a little sideways now.

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect (as some) for the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.9% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through January) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to May 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to December 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to March 2003, and the CoreLogic index back to April 2003.

In real terms, house prices are back to 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to March 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and maybe moving a little sideways now.

Case-Shiller: National House Price Index increased 4.5% year-over-year in January

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Rise in Home Prices Paced by Denver, Miami, and Dallas According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 15.9% from the peak, and up 0.9% in January (SA).

The Composite 20 index is off 14.9% from the peak, and up 0.9% (SA) in January.

The National index is off 7.9% from the peak, and up 0.5% (SA) in January. The National index is up 24.3% from the post-bubble low set in Dec 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.

The Composite 10 SA is up 4.4% compared to January 2014.

The Composite 20 SA is up 4.6% year-over-year..

The National index SA is up 4.5% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in January seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 41.4% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.6% YoY increase for the National index. I'll have more on house prices later.

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Rise in Home Prices Paced by Denver, Miami, and Dallas According to the S&P/Case-Shiller Home Price Indices

Data released today for January 2015 show that home prices continued their rise across the country over the last 12 months. However, monthly data reveal slowing increases and seasonal weakness. ... Both the 10-City and 20-City Composites saw year-over-year increases in January compared to December. The 10-City Composite gained 4.4% year-over-year, up from 4.3% in December. The 20-City Composite gained 4.6% year-over-year, compared to a 4.4% increase in December. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.5% annual gain in January 2015 versus a 4.6% increase in December 2014.

...

The National index declined for the fifth consecutive month in January, reporting a -0.1% change for the month. Both the 10- and 20-City Composites reported virtually flat month-over-month changes. Of the nine cities that reported increases, Charlotte, Miami, and San Diego led all cities in January with increases of 0.7%. San Francisco reported the largest decrease of all 20 cities, with a month over-month decrease of -0.9%. Seattle and Washington D.C. reported decreases of -0.5%. U

...

“The combination of low interest rates and strong consumer confidence based on solid job growth, cheap oil and low inflation continue to support further increases in home prices” says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Dow Jones Indices. “Regional patterns in recent months continue: strength in the west and southwest paced by Denver and Dallas with results ahead of the national index in the California cities, the Pacific Northwest and Las Vegas. The northeast and Midwest are mostly weaker than the national index.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 15.9% from the peak, and up 0.9% in January (SA).

The Composite 20 index is off 14.9% from the peak, and up 0.9% (SA) in January.

The National index is off 7.9% from the peak, and up 0.5% (SA) in January. The National index is up 24.3% from the post-bubble low set in Dec 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.4% compared to January 2014.

The Composite 20 SA is up 4.6% year-over-year..

The National index SA is up 4.5% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in January seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 41.4% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.6% YoY increase for the National index. I'll have more on house prices later.

Monday, 30 March 2015

Tuesday: Case-Shiller House Prices, Chicago PMI

From the WSJ: Fed’s Fischer Floats Ideas for Regulating Shadow Banks

• 9:00 AM ET, the S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices. The consensus is for a 4.6% year-over-year increase in the National Index for January. The Zillow forecast is for the National Index to increase 4.6% year-over-year in January, and for prices to increase 0.5% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.2, up from 45.8 in February.

The Federal Reserve’s No. 2 official floated a series of ideas for regulating nonbank financial companies, the latest indication that top U.S. policy makers are focusing on risks in the so-called shadow banking sector.Tuesday:

“While there has been progress on the financial reform front, we should not be complacent about the stability of the financial system,” said Fed Vice Chairman Stanley Fischer in remarks prepared for a conference here hosted by the Federal Reserve Bank of Atlanta. He noted existing rules create an incentive for risky activities to move into less-regulated financial firms and said “we should expect that further reforms will certainly be needed down the road.”

• 9:00 AM ET, the S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices. The consensus is for a 4.6% year-over-year increase in the National Index for January. The Zillow forecast is for the National Index to increase 4.6% year-over-year in January, and for prices to increase 0.5% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.2, up from 45.8 in February.

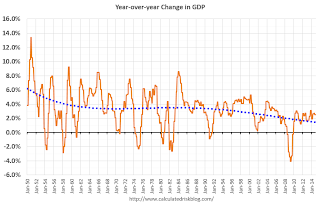

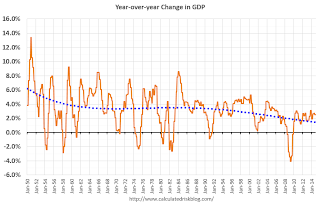

Demographics and GDP: 2% is the new 4%

Note: This is a repeat of a post I wrote early this year. Based on some recent comments I've seen, I think this is worth repeating.

For amusement, I checked out the WSJ opinion page comments on the Q4 GDP report. As usual, the WSJ opinion is pure politics - but it does bring up an excellent point (that the WSJ conveniently ignores).

First, from the WSJ opinion page:

And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis (that the WSJ opinion page missed).

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

Click on graph for larger image

Click on graph for larger image

The data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly recently after declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has just started growing again after declining for a few years (see Prime Working-Age Population Growing Again)

Now here is a look at GDP for the same period.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend.

GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

Now lets put the two graphs together.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.

The good news is that will change going forward (prime working age population will grow faster next decade). The bad news is the political hacks will continue to ignore demographics.

Right now, due to demographics, 2% GDP growth is the new 4%.

For amusement, I checked out the WSJ opinion page comments on the Q4 GDP report. As usual, the WSJ opinion is pure politics - but it does bring up an excellent point (that the WSJ conveniently ignores).

First, from the WSJ opinion page:

The fourth quarter report means that growth for all of 2014 clocked in at 2.4%, which is the best since 2.5% in 2010. It also means another year, an astonishing ninth in a row, in which the economy did not grow by 3%.This period of low growth isn't "astonishing". First, usually following a recession, there is a brief period of above average growth - but not this time due to the financial crisis and need for households to deleverage. So we didn't see a strong bounce back (sluggish growth was predicted on the blog for the first years of the recovery).

And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis (that the WSJ opinion page missed).

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

Click on graph for larger image

Click on graph for larger imageThe data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly recently after declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has just started growing again after declining for a few years (see Prime Working-Age Population Growing Again)

Now here is a look at GDP for the same period.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend. GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

Now lets put the two graphs together.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.The good news is that will change going forward (prime working age population will grow faster next decade). The bad news is the political hacks will continue to ignore demographics.

Right now, due to demographics, 2% GDP growth is the new 4%.

NAR: Pending Home Sales Index increased 3.1% in February, up 12% year-over-year

From the NAR: Pending Home Sales Rise in February Behind Solid Gains in Midwest, West

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.1 percent to 106.9 in February from a slight downward revision of 103.7 in January and is now 12.0 percent above February 2014 (95.4). The index is at its highest level since June 2013 (109.4), has increased year-over-year for six consecutive months and is above 100 – considered an average level of activity – for the 10th consecutive month.This was well above the consensus forecast, but as expected by housing economist Tom Lawler.

...

The PHSI in the Northeast fell 2.3 percent to 81.7 in February, but is 4.1 percent above a year ago. In the Midwest the index leaped 11.6 percent to 110.4 in February, and is now 13.8 percent above February 2014.

Pending home sales in the South decreased 1.4 percent to an index of 120.2 in February, but is still 10.8 percent above last February. The index in the West climbed 6.6 percent in February to 102.1 (highest since June 2013 at 111.4) and is now 18.3 percent above a year ago.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

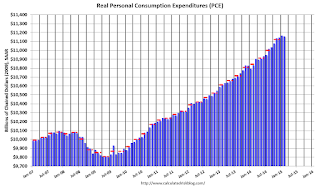

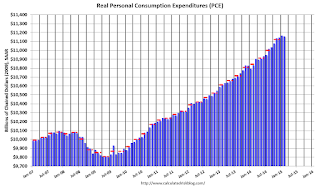

Personal Income increased 0.4% in February, Spending increased 0.1%

The BEA released the Personal Income and Outlays report for February:

Click on graph for larger image.

Click on graph for larger image.

The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was higher than expected, The increase in PCE was below the 0.2% increase consensus.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.4 percent year-over-year in February.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 2.0% annual rate in Q1 2015 (using the mid-month method, PCE was increasing 0.8%). This is a slowdown in PCE.

Personal income increased $58.6 billion, or 0.4 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE)increased $11.8 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in February, in contrast to an increase of 0.2 percent in January. ... The price index for PCE increased 0.2 percent in February, in contrast to a decrease of 0.4 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

The February price index for PCE increased 0.3 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.4 percent from February a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was higher than expected, The increase in PCE was below the 0.2% increase consensus.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.4 percent year-over-year in February.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 2.0% annual rate in Q1 2015 (using the mid-month method, PCE was increasing 0.8%). This is a slowdown in PCE.

Sunday, 29 March 2015

Monday: Personal Income and Outlays, Pending Home Sales, Dallas Fed Mfg

From the NY Times: A Deadline for Greece, and U.S. Jobs Data

• 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the Pending Home Sales Index for February. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March.

Weekend:

• Schedule for Week of March 29, 2015

• Lawler: Possible Upside Surprise for Pending Home Sales Index

• Merrill and Nomura Forecasts for March Employment Report

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down slightly and DOW futures are flat (fair value).

Oil prices were up slightly over the last week with WTI futures at $48.34 per barrel and Brent at $55.97 per barrel. A year ago, WTI was at $101, and Brent was at $106 - so prices are down 50% or so year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.42 per gallon (down more than $1.10 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

Greece hopes to gain approval on Monday for a detailed list of economic changes that its international creditors have demanded ...Monday:

... recent economic data has been anemic, and it is likely that hiring has not kept up with the blistering pace of gains reached in late 2014. In fact, some economists say hiring could fall below the 200,000 level because of a combination of bad weather and weakness in certain sectors like drilling and energy production.

• 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the Pending Home Sales Index for February. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March.

Weekend:

• Schedule for Week of March 29, 2015

• Lawler: Possible Upside Surprise for Pending Home Sales Index

• Merrill and Nomura Forecasts for March Employment Report

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down slightly and DOW futures are flat (fair value).

Oil prices were up slightly over the last week with WTI futures at $48.34 per barrel and Brent at $55.97 per barrel. A year ago, WTI was at $101, and Brent was at $106 - so prices are down 50% or so year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.42 per gallon (down more than $1.10 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Lawler: Possible Upside Surprise for Pending Home Sales Index

CR Note: The NAR is scheduled to release Pending Home Sales for February tomorrow at 10:00 AM ET. The consensus is for a 0.3% increase in the index. Housing economist Tom Lawler mentioned in his existing home sales forecast a week ago:

Lawler sent me a note today:

Look for a possible upside surprise tomorrow.

While not enough local realtors/MLS either report data on new pending sales or report accurate/consistent data on new pending sales for me to produce a “national” estimate, most or the realtors/MLS that do report such data showed significantly faster YOY growth in pending sales in February compared to January.Note: The NAR reported Pending Home sales increased 1.7% in January.

Lawler sent me a note today:

Based on the admittedly limited number of other publicly-available regional/MLS reports on pending home sales, I'd look for an "upside surprise" to the NAR's Pending Home Sales Index for February.Lawler added this example of local data from the California Association of Realtors:

• California pending home sales jumped in February, with the Pending Home Sales Index (PHSI)* increasing 24.8 percent from a revised 89.9 in January to 112.2, based on signed contracts. The month-to-month increase easily topped the long-run average increase of 17.9 percent observed in the last seven years.Note: The YOY increase in the CAR PHSI in January was 6.0%.

• Statewide pending home sales were up 15.6 percent on an annual basis from the 97.1 index recorded in February 2014. The yearly increase was the largest since April 2009 and was the first double-digit gain since April 2012.

Look for a possible upside surprise tomorrow.

Merrill and Nomura Forecasts for March Employment Report

Here are some excepts from two research reports ... first from Merrill Lynch:

The consensus is for the unemployment rate to be unchanged at 5.5% in March.

I'll write an employment report preview later this week after more data for March is released.

The recent employment reports have been exceptionally strong with job growth averaging 293,000 a month for the past six months. Although we expect a slight moderation in March with job growth of 270,000, this would still be a healthy number. Within the components, we should continue to see a shedding of jobs in the mining sector, which lost a cumulative 14,000 over the past two months. The plunge in oil prices has resulted in layoffs in oil and gas production. Elsewhere, we expect decent growth in construction jobs but a slowdown in manufacturing hiring given the recent weakness in the PMI surveys. We will also be closely looking at the trend in retail hiring as an indicator of the beginning of the spring shopping season. Overall, this will leave private payroll growth of 260,000 and public of 10,000.From Nomura:

Despite strong job growth, we think the unemployment rate will tick up to 5.6%. The unrounded unemployment rate in February was 5.54%, making it a “high” 5.5%. The risk is that the labor force participation rate increases, reversing the decline in February. As always, the focus will be on wages. We look for a 0.2% gain, an improvement from the 0.12% increase in February. This would leave the yoy rate at 2.0%. We think the risk, however, is that average hourly earnings surprises on the upside relative to our forecast.

Job growth has been very strong recently. Incoming data have tilted negative in March, but on balance still suggest that payrolls increased at a solid pace. Regional manufacturing surveys released thus far in March have come in less optimistic, suggesting that manufacturing jobs probably grew at a slower rate. Initial and continuing jobless claims have remained low throughout the month but were higher in the BLS survey period in March compared with the same period in February.The consensus is for an increase of 247,000 non-farm payroll jobs in March, down from the 295,000 non-farm payroll jobs added in February.

Based on readings of these labor market indicators, we forecast a 220k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 225k. Given the weaker regional manufacturing surveys, we expect manufacturing employment to grow by 5k, compared with 8k in February. We forecast that average hourly earnings for private employees rose by 0.3% m-o-m in March, indicative of our expectation for a gradual pickup in wage growth as a result of the tightening labor market and also representing some bounce back after the unusually weak number in February. Last, we expect the household survey to show that the unemployment rate ticked down by 0.1pp to 5.4%.

The consensus is for the unemployment rate to be unchanged at 5.5% in March.

I'll write an employment report preview later this week after more data for March is released.

Saturday, 28 March 2015

Schedule for Week of March 29, 2015

The key report this week is the March employment report on Friday.

Other key indicators include the February Personal Income and Outlays report on Monday, March ISM manufacturing index also on Wednesday, March vehicle sales on Wednesday, and the February Trade Deficit on Thursday.

Also, Reis will release their quarterly surveys of rents and vacancy rates for offices, apartments and malls.

----- Monday, March 30th -----

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for March.

----- Tuesday, March 31st -----

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the National Index for January. The Zillow forecast is for the National Index to increase 4.6% year-over-year in January, and for prices to increase 0.5% month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.2, up from 45.8 in February.

----- Wednesday, April 1st -----

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 225,000 payroll jobs added in March, up from 212,000 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for a decrease to 52.5 from 52.9 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for a decrease to 52.5 from 52.9 in February.

Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in February at 52.9%. The employment index was at 51.4%, and the new orders index was at 52.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.2% increase in construction spending.

Early: Reis Q1 2015 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 16.8 million SAAR in March from 16.2 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 16.8 million SAAR in March from 16.2 million in February (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

----- Thursday, April 2nd -----

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 282 thousand.

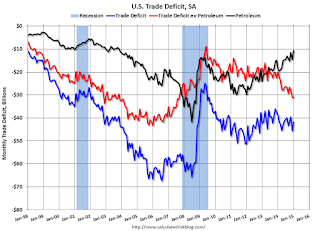

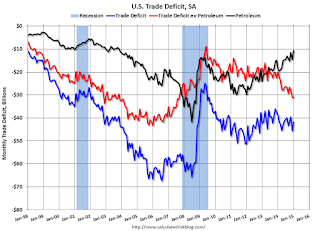

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau.

This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in February from $41.8 billion in January.

Early: Reis Q1 2015 Apartment Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for no change in February orders.

----- Friday, April 3rd -----

8:30 AM: Employment Report for March. The consensus is for an increase of 247,000 non-farm payroll jobs added in March, down from the 295,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to be unchanged at 5.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.

In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since the '90s.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should start to pickup.

Early: Reis Q1 2015 Mall Survey of rents and vacancy rates.

Other key indicators include the February Personal Income and Outlays report on Monday, March ISM manufacturing index also on Wednesday, March vehicle sales on Wednesday, and the February Trade Deficit on Thursday.

Also, Reis will release their quarterly surveys of rents and vacancy rates for offices, apartments and malls.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for March.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the National Index for January. The Zillow forecast is for the National Index to increase 4.6% year-over-year in January, and for prices to increase 0.5% month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.2, up from 45.8 in February.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 225,000 payroll jobs added in March, up from 212,000 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for a decrease to 52.5 from 52.9 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for a decrease to 52.5 from 52.9 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in February at 52.9%. The employment index was at 51.4%, and the new orders index was at 52.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.2% increase in construction spending.

Early: Reis Q1 2015 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 16.8 million SAAR in March from 16.2 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 16.8 million SAAR in March from 16.2 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 282 thousand.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in February from $41.8 billion in January.

Early: Reis Q1 2015 Apartment Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for no change in February orders.

8:30 AM: Employment Report for March. The consensus is for an increase of 247,000 non-farm payroll jobs added in March, down from the 295,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to be unchanged at 5.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since the '90s.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should start to pickup.

Early: Reis Q1 2015 Mall Survey of rents and vacancy rates.

Unofficial Problem Bank list decline to 349 Institutions in March, Q1 2015 Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 2015.

Changes and comments from surferdude808:

Here is the unofficial problem bank list for March 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for March 2015. During the month, the list fell from 357 institutions to 349 after nine removals and one addition. Assets dropped by $2.9 billion to an aggregate $106.2 billion. A year ago, the list held 538 institutions with assets of $174.3 billion.

Actions were terminated against First National Community Bank Dunmore, PA, ($969 million Ticker: FNCB); Colorado East Bank & Trust, Lamar, CO, ($769 million); Bay Cities Bank, Tampa, FL ($519 million); The Citizens Bank, Nashville, GA, ($259 million); Grand Bank & Trust of Florida, West Palm Beach, FL ($208 million); The Bank of Washington, Lynnwood, WA, ($152 million); Capitol National Bank, Lansing, MI ($115 million Ticker: CBCRQ); and Fox River State Bank, Burlington, WI ($73 million).

First Tuskegee Bank, Tuskegee, AL ($52 million) find its way off the list by merging with the minority-controlled Liberty Bank and Trust Company that is based in New Orleans, LA.

The addition this month was Harvest Community Bank, Pennsville, NJ ($184 million Ticker: HCBP).

With it being the end of the first quarter, we bring an update on the transition matrix. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,691 institutions have appeared on the list at some point. There have been 1,342 institutions have come and gone on the list. Departure methods include 724 action terminations, 391 failures, 213 mergers, and 14 voluntary liquidations. The first quarter of 2015 started with 401 institutions on the list, so the 48 action terminations during the quarter reduced the list by 12 percent. Although it is easier to achieve a high removal percentage given the smaller overall list count, the 12 percent quarterly removal rate is the fastest since the list has been published. Of the 389 institutions on the first published list, 45 still remain nearly six years later. The 391 failures are 23.1 percent of the 1,691 institutions that have appeared on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 150 | (57,648,218) | |

| Unassisted Merger | 36 | (8,760,484) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (4,361,945) | ||

| Still on List at 3/31/2015 | 45 | 10,689,090 | |

| Additions after 8/7/2009 | 304 | 95,551,036 | |

| End (3/31/2015) | 349 | 106,240,126 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 574 | 234,619,564 | |

| Unassisted Merger | 177 | 75,762,416 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 237 | 119.479,684 | |

| Total | 998 | 432,185,806 | |

| 1Institution not on 8/7/2009 or 3/31/2015 list but appeared on a weekly list. | |||

Friday, 27 March 2015

Hotels: On Pace for Best Year on Record

From HotelNewsNow.com: STR: US hotel results for week ending 21 March

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will be solid over the next couple of months.

Click on graph for larger image.

Click on graph for larger image.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at slightly above the level for 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 15-21 March 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 3.2 percent to 69.3 percent. Average daily rate increased 6.6 percent to finish the week at US$122.46. Revenue per available room for the week was up 10.0 percent to finish at US$84.89.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will be solid over the next couple of months.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at slightly above the level for 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Yellen: Normalizing Monetary Policy: Prospects and Perspectives

From Fed Chair Janet Yellen: Normalizing Monetary Policy: Prospects and Perspectives. Excerpts:

Why Might an Increase in the Federal Funds Rate Be Warranted Later This Year?

The Committee's decision about when to begin reducing accommodation will depend importantly on how economic conditions actually evolve over time. Like most of my FOMC colleagues, I believe that the appropriate time has not yet arrived, but I expect that conditions may warrant an increase in the federal funds rate target sometime this year. So let me spell out the reasoning that underpins this view.

I would first note that the current stance of monetary policy is clearly providing considerable economic stimulus. The near-zero setting for the federal funds rate has facilitated a sizable reduction in labor market slack over the past two years and appears to be consistent with further substantial gains. A modest increase in the federal funds rate would be highly unlikely to halt this progress, although such an increase might slow its pace somewhat.

Second, we need to keep in mind the well-established fact that the full effects of monetary policy are felt only after long lags. This means that policymakers cannot wait until they have achieved their objectives to begin adjusting policy. I would not consider it prudent to postpone the onset of normalization until we have reached, or are on the verge of reaching, our inflation objective. Doing so would create too great a risk of significantly overshooting both our objectives of maximum sustainable employment and 2 percent inflation, potentially undermining economic growth and employment if the FOMC is subsequently forced to tighten policy markedly or abruptly. In addition, holding rates too low for too long could encourage inappropriate risk-taking by investors, potentially undermining the stability of financial markets. That said, we must be reasonably confident at the time of the first rate increase that inflation will move up over time to our 2 percent objective, and that such an action will not impede continued solid growth in employment and output.

An important factor working to increase my confidence in the inflation outlook will be continued improvement in the labor market. A substantial body of theory, informed by considerable historical evidence, suggests that inflation will eventually begin to rise as resource utilization continues to tighten.2 It is largely for this reason that a significant pickup in incoming readings on core inflation will not be a precondition for me to judge that an initial increase in the federal funds rate would be warranted. With respect to wages, I anticipate that real wage gains for American workers are likely to pick up to a rate more in line with trend labor productivity growth as employment settles in at its maximum sustainable level. We could see nominal wage growth eventually running notably higher than the current roughly 2 percent pace. But the outlook for wages is highly uncertain even if price inflation does move back to 2 percent and labor market conditions continue to improve as projected. For example, we cannot be sure about the future pace of productivity growth; nor can we be sure about other factors, such as global competition, the nature of technological change, and trends in unionization, that may also influence the pace of real wage growth over time. These factors, which are outside of the Federal Reserve's control, likely explain why real wages have failed to keep pace with productivity growth for at least the past 15 years. For such reasons, we can never be sure what growth rate of nominal wages is consistent with stable consumer price inflation, and this uncertainty limits the usefulness of wage trends as an indicator of the Fed's progress in achieving its inflation objective.

I have argued that a pickup in neither wage nor price inflation is indispensable for me to achieve reasonable confidence that inflation will move back to 2 percent over time. That said, I would be uncomfortable raising the federal funds rate if readings on wage growth, core consumer prices, and other indicators of underlying inflation pressures were to weaken, if market-based measures of inflation compensation were to fall appreciably further, or if survey-based measures were to begin to decline noticeably.

Under normal circumstances, simple monetary policy rules, such as the one proposed by John Taylor, could help us decide when to raise the federal funds rate. Even with core inflation running below the Committee's 2 percent objective, Taylor's rule now calls for the federal funds rate to be well above zero if the unemployment rate is currently judged to be close to its normal longer-run level and the "normal" level of the real federal funds rate is currently close to its historical average. But the prescription offered by the Taylor rule changes significantly if one instead assumes, as I do, that appreciable slack still remains in the labor market, and that the economy's equilibrium real federal funds rate--that is, the real rate consistent with the economy achieving maximum employment and price stability over the medium term--is currently quite low by historical standards.Under assumptions that I consider more realistic under present circumstances, the same rules call for the federal funds rate to be close to zero. Moreover, I would assert that simple rules are, well, too simple, and ignore important complexities of the current situation, about which I will have more to say shortly.

The FOMC will, of course, carefully deliberate about when to begin the process of removing policy accommodation. But the significance of this decision should not be overemphasized, because what matters for financial conditions and the broader economy is the entire expected path of short-term interest rates and not the precise timing of the first rate increase. The spending and investment decisions the FOMC seeks to influence depend primarily on expectations of policy well into the future, as embedded in longer-term interest rates and other asset prices. More important than the timing of the Committee's initial policy move will be the strategy the Committee deploys in adjusting the federal funds rate over time, in response to economic developments, to achieve its dual mandate. Market participants' perceptions of that reaction function and the implications for the likely longer-run trajectory of short-term interest rates will influence the borrowing costs faced by households and businesses, including the rates on corporate bonds, auto loans, and home mortgages.

BLS: Twenty-Six States had Unemployment Rate Decreases in February

From the BLS: Regional and State Employment and Unemployment Summary

Click on graph for larger image.

Click on graph for larger image.

This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher. North Dakota had had the lowest unemployment rate for 75 consecutive months, however Nebraska was the lowest in February.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

Currently no state has an unemployment rate at or above 8% (light blue); Two states and D.C. are still at or above 7% (dark blue).

Regional and state unemployment rates were little changed in February. Twenty-six states had unemployment rate decreases from January, 6 states and the District of Columbia had increases, and 18 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in February, 2.7 percent, followed by North Dakota, 2.9 percent. Nevada had the highest rate among the states, 7.1 percent. The District of Columbia had a rate of 7.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher. North Dakota had had the lowest unemployment rate for 75 consecutive months, however Nebraska was the lowest in February.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Two states and D.C. are still at or above 7% (dark blue).

Final March Consumer Sentiment at 93.0

Click on graph for larger image.

The final University of Michigan consumer sentiment index for March was at 93.0, up from the preliminary estimate of 91.2, and down from 95.4 in February.

This was above the consensus forecast of 91.8. Gasoline prices have probably been the key factor for the recent changes in sentiment.

Q4 GDP unrevised at 2.2% Annual Rate

From the BEA: Gross Domestic Product: Fourth Quarter 2014 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.2 percent in the fourth quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.Here is a Comparison of Third and Secord Estimates. PCE was revised up from 4.2% to 4.4% - solid. Private investment was revised down from 5.1% to 3.7%. This was below expectations of a revision to 2.4%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 2.2 percent. While increases in exports and in personal consumption expenditures (PCE) were larger than previously estimated and the change in private inventories was smaller, GDP growth is unrevised, and the general picture of the economy for the fourth quarter remains the same

Thursday, 26 March 2015

Friday: Yellen, GDP, Consumer Sentiment

From Merrill Lynch on the March employment report:

• 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (third estimate). The consensus is that real GDP increased 2.4% annualized in Q4, up from the second estimate of 2.2%.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 91.8, up from the preliminary reading of 91.2, but down from the February reading of 95.4.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly), February 2015

• At 3:45 PM, Speech, Fed Chair Janet Yellen, Monetary Policy, At the Federal Reserve Bank of San Francisco Conference: The New Normal for Monetary Policy, San Francisco, Calif

The recent employment reports have been exceptionally strong with job growth averaging 293,000 a month for the past six months. Although we expect a slight moderation in March with job growth of 270,000, this would still be a healthy number. ...Friday:

Despite strong job growth, we think the unemployment rate will tick up to 5.6%. ... The risk is that the labor force participation rate increases, reversing the decline in February. As always, the focus will be on wages. We look for a 0.2% gain, an improvement from the 0.12% increase in February. This would leave the yoy rate at 2.0%. We think the risk, however, is that average hourly earnings surprises on the upside relative to our forecast.

• 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (third estimate). The consensus is that real GDP increased 2.4% annualized in Q4, up from the second estimate of 2.2%.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 91.8, up from the preliminary reading of 91.2, but down from the February reading of 95.4.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly), February 2015

• At 3:45 PM, Speech, Fed Chair Janet Yellen, Monetary Policy, At the Federal Reserve Bank of San Francisco Conference: The New Normal for Monetary Policy, San Francisco, Calif

Mortgage News Daily: Mortgage Rates increased Today

Earlier I posted the results of the weekly Freddie Mac survey that showed rates declined recently. However mortgage rates increased today.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Increase Rapidly

From Matthew Graham at Mortgage News Daily: Mortgage Rates Increase Rapidly

Mortgage rates rose rapidly today, almost completely erasing the improvement following last week's Fed Announcement. This is especially ironic considering most major media outlets are running Freddie Mac's weekly mortgage rate survey headline. Because that survey receives most of its responses on Monday and Tuesday, it fully benefited from the stronger levels earlier in the week after having totally missed out on last Wednesday and Thursday's big move lower. As such, the headlines suggest that rates are significantly lower this week. That was certainly true on Tuesday afternoon, but rates have risen roughly an eighth of a point since then. That's a big move considering we've gone entire months without moving more than an eighth.Here is a table from Mortgage News Daily:

Specifically, what had been 3.625 to 3.75% is now 3.75 to 3.875% in terms of the most prevalently-quoted conventional 30yr fixed rates for top tier scenarios. The upfront costs associated with moving down to 3.75 from 3.875% are still quite low.

Freddie Mac: 30 Year Mortgage Rates decrease to 3.69% in Latest Weekly Survey

From Freddie Mac today: Mortgage Rates Move Down Again

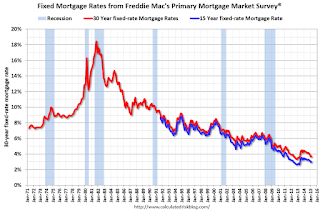

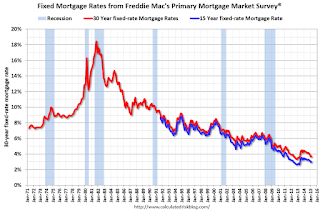

Click on graph for larger image.

Click on graph for larger image.

This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.40% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down again across the board. Average fixed rates that continue to run below four percent will help keep affordability high for those in the market to buy a home as we head into the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending March 26, 2015, down from last week when it averaged 3.78 percent. A year ago at this time, the 30-year FRM averaged 4.40 percent.

15-year FRM this week averaged 2.97 percent with an average 0.6 point, down from last week when it averaged 3.06 percent. A year ago at this time, the 15-year FRM averaged 3.42 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.40% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Kansas City Fed: Regional Manufacturing Activity Declined in March

From the Kansas City Fed: Tenth District Manufacturing Activity Declined

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive.Some of this decline was due to lower oil prices (Oklahoma was especially weak), however overall, lower oil prices will a positive for the economy. Also some of this decline was related to the West Coast port labor issues that are now resolved.

“We saw our first monthly decline in regional factory activity in over a year," said Wilkerson. “Some firms blamed the West Coast port disruptions, while producers of oil and gas-related equipment blamed low oil prices.”

Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive. Most price indexes continued to decrease, with several reaching their lowest level since 2009. In a special question about the West Coast port disruptions, 32 percent of firms said it had affected them negatively.

The month-over-month composite index was -4 in March, down from 1 in February and 3 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to declines in plastics, food, and chemical production and continued weakness in metals and machinery. Looking across District states, the largest decline was in Oklahoma, with moderate slowdowns in Kansas and Nebraska. ... the employment and new orders for exports indexes inched higher but remained negative.

emphasis added

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.

Weekly Initial Unemployment Claims decreased to 282,000

The DOL reported:

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,000.

This was below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 282,000, a decrease of 9,000 from the previous week's unrevised level of 291,000. The 4-week moving average was 297,000, a decrease of 7,750 from the previous week's unrevised average of 304,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,000.

This was below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, 25 March 2015

Thursday: Unemployment Claims, Kansas City Mfg Survey

Some excerpts from a research piece by Goldman Sachs economist Kris Dawsey: Core Inflation Still Has Room to Fall

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

... With the PPI and CPI reports already in hand for the month, we think that the core PCE price index—the Fed’s preferred inflation measure—will post an above-trend 0.20% increase in February. ... In light of the latest news, one might be tempted to wonder whether we have seen the bottom on core inflation, which could help the Fed to be "reasonably confident" that inflation will be moving back to its target over the medium term—a precondition for the first rate hike.Thursday:

We ... find that in the near term downward pressure on core inflation from the effects of the stronger dollar and energy price pass-through are likely to overwhelm upward pressure from diminished slack in the economy. ... Recent firmness in shelter inflation—which appears insensitive to dollar and oil effects—is likely to persist, but we think that core goods inflation will probably move down further. Our bottom-up analysis suggests that headline and core consumer prices will probably bottom around the middle of the year ...

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

Vehicle Sales Forecasts: Best March since 2005

The automakers will report March vehicle sales on Wednesday, April 1st. Sales in February were at 16.2 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales rebounded in March to close to 17.0 million SAAR. March sales (SA) will probably be the best since 2005.

Note: There were 25 selling days in March, one less than last year. Here are a couple of forecasts:

From WardsAuto: Forecast: March Sales Spring Forward

Note: There were 25 selling days in March, one less than last year. Here are a couple of forecasts:

From WardsAuto: Forecast: March Sales Spring Forward

A WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles this month. The forecasted daily sales rate (DSR) of 60,935 over 25 days represents a 3.5% improvement from like-2014 (26 days). ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, compared with year-ago’s 16.4 million and February’s 16.2 million mark.From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Rebound in March to Highest Levels for the Month since 2005

U.S. total new-vehicle sales in March 2015 are bouncing back from last month and are expected to reach their highest levels for the month in a decade, according to a monthly sales forecast from J.D. Power and LMC Automotive.Looks like a strong month for auto sales.

After winter storms stymied sales in February, total new light-vehicle sales in March 2015 are expected to reach 1,539,600 units, a 4 percent increase on a selling-day adjusted basis compared with March 2014 and their highest levels for the month since March 2005 when 1,572,909 new vehicles were sold. [17.0 million SAAR[

New Home Prices: More homes priced in the $200K to $300K range

Here are two graphs I haven't posted for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in February 2015 was $275,500; the average sales price was $341,000."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

Recently some builders have announced new homes at lower price points.

The average price in February 2015 was $341,000 and the median price was $275,500. Both are above the bubble high (this is due to both a change in mix and rising prices), but are below the recent peak.

The second graph shows the percent of new homes sold by price.

Less than 5% of homes sold were under $150K in February 2015. This is down from 30% in 2002 - and down from 20% as recently as August 2011. The under $150K new home is probably going away.

Less than 5% of homes sold were under $150K in February 2015. This is down from 30% in 2002 - and down from 20% as recently as August 2011. The under $150K new home is probably going away.

However there has been a pickup in homes sold in the $200K to $300K range (Up to 37.8% of homes in February 2015).

Yesterday on New Home Sales:

• New Home Sales at 539,000 Annual Rate in February

• Comments on New Home Sales