Note: As usually happens, housing economist Tom Lawler's estimate was closer than the consensus to the NAR reported sales rate.

Also, the NAR reported total sales were up 3.2% from January 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales – foreclosures and short sales – were 11 percent of sales in January, unchanged from last month but down from 15 percent a year ago. Eight percent of January sales were foreclosures and 3 percent were short sales.Last year in December the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in January 2014 were reported at 4.67 million SAAR with 15% distressed. That gives 701 thousand distressed (annual rate), and 3.97 million equity / non-distressed. In January 2015, sales were 4.82 million SAAR, with 11% distressed. That gives 530 thousand distressed - a decline of about 24% from January 2014 - and 4.29 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 8%.

Important: If total existing sales decline a little, or move side-ways - due to fewer distressed sales- that is a positive sign for real estate.

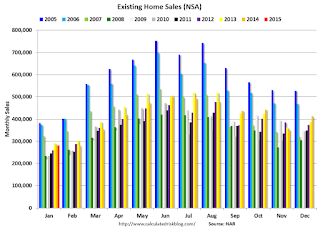

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in January (red column) were slightly higher than last year (NSA), and below sales in January 2013.

Earlier:

• Existing Home Sales in January: 4.82 million SAAR, Inventory down slightly Year-over-year

No comments:

Post a Comment