From Fannie Mae:

The continued decrease in the number of our seriously delinquent single-family loans, as well as lengthy foreclosure timelines in a number of states, have resulted in a reduction in the number of REO acquisitions and fewer dispositions in 2014 compared with 2013 and 2012.The decline in REO is related to fewer delinquencies (higher house prices and a better economy), and long foreclosure time lines in some states (like Florida).

...

We recognized a benefit for credit losses in 2014 primarily due to increases in home prices of 4.7% in 2014. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default, which impacts our estimate of losses and ultimately reduces our total loss reserves and provision for credit losses.

emphasis added

Click on graph for larger image.

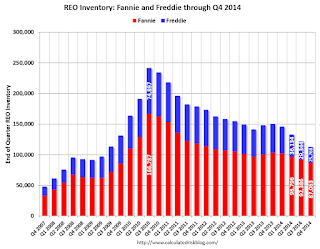

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 25% year-over-year. For Freddie, this is the lowest level of REO since Q2 2008. For Fannie, this is the lowest level since 2009.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

No comments:

Post a Comment