The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.8 billion in January, down $3.8 billion from $45.6 billion in December, revised. January exports were $189.4 billion, down $5.6 billion from December. January imports were $231.2 billion, down $9.4 billion from December.The trade deficit was at the consensus forecast of $41.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in January (some impact of West Coast port slowdown).

Exports are 14% above the pre-recession peak and down 2% compared to January 204; imports are at the pre-recession peak, and unchanged compared to January 2014.

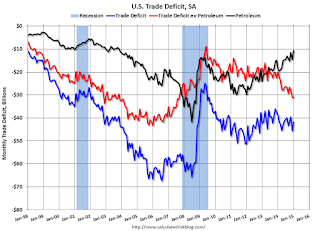

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $58.96 in January, down from $73.64 in December, and down from $90.21 in January 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts.

The trade deficit with China increased to $28.6 billion in January, from $27.8 billion in January 2013. The deficit with China is a large portion of the overall deficit.

The decrease in the trade deficit was due to a lower volume and lower price of oil imports (volatile month-to-month), and a slightly larger deficit with the Euro Area ($8.0 billion in Jan 2015 compared to $7.2 billion in Jan 2014).

No comments:

Post a Comment