From the AIA: Architecture Billings Index Accelerates in March

For the second consecutive month, the Architecture Billings Index (ABI) indicated a modest increase in design activity in March. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.7, up from a mark of 50.4 in February. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.2, up from a reading of 56.6 the previous month.

“Business conditions at architecture firms generally are quite healthy across the country. However, billings at firms in the Northeast were set back with the severe weather conditions, and this weakness is apparent in the March figures,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The multi-family residential market has seen its first occurrence of back-to-back negative months for the first time since 2011, while the institutional and commercial sectors are both on solid footing.”

emphasis added

Click on graph for larger image.

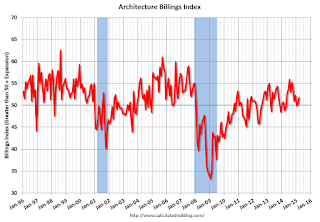

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.7 in March, up from 50.4 in February. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative in consecutive months for the first time since 2011 - and this might be indicating a slowdown for apartments. (just two months)

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was mostly positive over the last year, suggesting an increase in CRE investment in 2015.

No comments:

Post a Comment