Also note that oil imports have increase recently (the U.S. is a large oil importer).

Here is an excerpt from the Weekly Petroleum Status Report

U.S. crude oil refinery inputs averaged over 15.9 million barrels per day during the week ending April 3, 2015, 201,000 barrels per day more than the previous week’s average. Refineries operated at 90.1% of their operable capacity last week. ...

U.S. crude oil imports averaged over 8.2 million barrels per day last week, up by 869,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.6 million barrels per day, 4.8% above the same four-week period last year. ...

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 10.9 million barrels from the previous week. At 482.4 million barrels, U.S. crude oil inventories are at the highest level for this time of year in at least the last 80 years.It is difficult to forecast oil and gasoline prices due to world events - and the response of producers to price changes, but currently the EIA expects gasoline prices to average $2.40/gal in 2015 according to the Short Term Energy Outlook released last week:

emphasis added

• On April 2, Iran and the five permanent members of the United Nations Security Council plus Germany (P5+1) reached a framework agreement that could result in the lifting of oil-related sanctions against Iran. Lifting sanctions could substantially change the STEO forecast for oil supply, demand, and prices by allowing a significantly increased volume of Iranian barrels to enter the market. If and when sanctions are lifted, the baseline forecast for world crude oil prices in 2016 could be reduced $5-$15/barrel (bbl) from the level presented in this STEO. ...

• Iran is believed to hold at least 30 million barrels in storage, and EIA believes Iran has the technical capability to ramp up crude oil production by at least 700,000 bbl/day (bbl/d) by the end of 2016. The pace and magnitude at which those volumes would reach the market would depend on the terms of a final agreement. For additional analysis of the possible oil market effects of a lifting of sanctions against Iran, please see analysis box for further discussion.

...

• During the 2015 April-through-September summer driving season, regular gasoline retail prices are forecast to average $2.45/gallon (gal) compared with $3.59/gal last summer. Based on EIA's gasoline price forecast, the average U.S. household is expected to spend about $700 less on gasoline in 2015 compared with 2014, as annual motor fuel expenditures are on track to fall to their lowest level in 11 years.

emphasis added

Click on graph for larger image

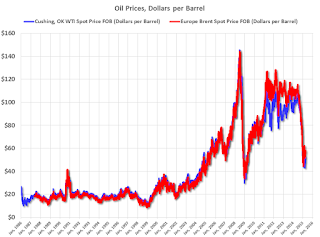

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices Friday added).

According to Bloomberg, WTI was at $51.64 per barrel on Friday, and Brent at $57.87.

WTI oil prices are off about 50% year-over-year.

No comments:

Post a Comment