Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 3, 2015. ...

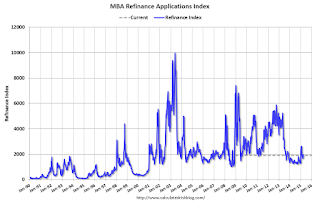

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier, reaching its highest level since July 2013. ... The unadjusted Purchase Index ... was 12 percent higher than the same week one year ago

...

“Purchase mortgage application volume last week increased to its highest level since July 2013, spurred on by still low mortgage rates and strengthening housing markets,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase volume has increased for three straight weeks now on a seasonally adjusted basis.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.86 percent from 3.89 percent, with points decreasing to 0.27 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.

No comments:

Post a Comment