Also, the NAR reported total sales were up 6.1% from April 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — were 10 percent of sales in April, unchanged from March and below the 15 percent share a year ago. Seven percent of April sales were foreclosures and 3 percent were short sales.Last year in April the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in April 2014 were reported at 4.75 million SAAR with 15% distressed. That gives 712 thousand distressed (annual rate), and 4.04 million equity / non-distressed. In April 2015, sales were 5.04 million SAAR, with 10% distressed. That gives 504 thousand distressed - a decline of about 29% from April 2014 - and 4.54 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 12%.

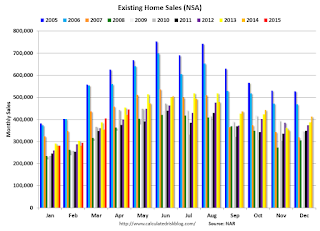

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were just below April 2013 (NSA).

Earlier:

• Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

No comments:

Post a Comment