The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2015 was estimated at a seasonally adjusted annual rate of $966.6 billion, 0.6 percent below the revised February estimate of $972.9 billion. The March figure is 2.0 percent above the March 2014 estimate of $947.3 billion.Both Private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $702.4 billion, 0.3 percent below the revised February estimate of $704.7 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In March, the estimated seasonally adjusted annual rate of public construction spending was $264.2 billion, 1.5 percent below the revised February estimate of $268.2 billion.

emphasis added

As an example, construction spending for lodging is up 22% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 16% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been moving sideways, and is 48% below the bubble peak.

Non-residential spending is 15% below the peak in January 2008.

Public construction spending is now 19% below the peak in March 2009 and about 1% above the post-recession low.

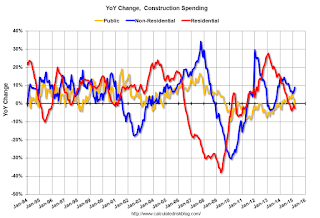

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 2.5%. Non-residential spending is up 9% year-over-year. Public spending is unchanged year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was below the consensus forecast of a 0.5% increase, however spending for January and February was revised up.

No comments:

Post a Comment